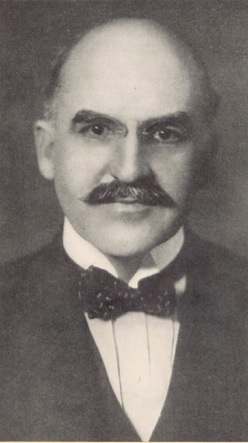

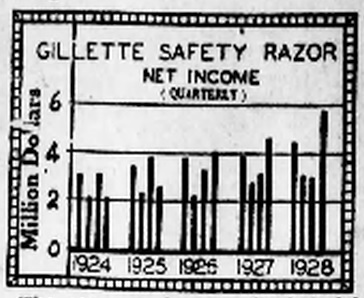

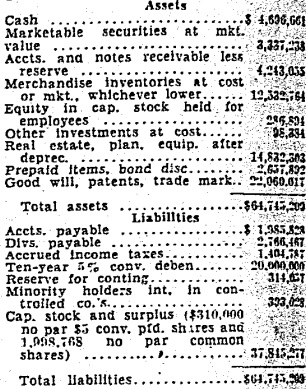

Henry Jacques Gaisman was a super-prolific inventor, genius of a businessman and self-made multimillionaire even though he left school when he was 13 years old.(81) He was born in Memphis Tennessee(81) on December 5, 1869(82) and died on August 6, 1974 at the age of 104;(1) another stellar achievement. He was the youngest of 4 children and his father died when he was 3.(81) He had to go to work at an early age as his family needed money and his first invention was at the age of 9 which paid him over $100 per month.(81, 92, 15) He is credited as the author of over 200 patents,(92) and Gaisman had an early interest in safety razors.(65) His first single edge safety razor was patented on May 10, 1904.(2) Gaisman founded the AutoStrop Safety Razor Company in 1906 at the age of 37(80) with $100,000(92) where he was at first president and then chairman of the board of directors.(15) In 1911 Gaisman had a camera invention allowing for writing on film(93) which sold to George Eastman of Kodak for $300,000.(92) Up until 1927, he owned almost all the stock in the company, when he started selling shares to raise capital to grow his business, all while keeping a majority of the ownership.(15) The advantage of his AutoStrop razor was that it was a compromise between a straight razor, that needs to be honed and stropped, and a Gillette blade which was disposable and needed neither.(3) AutoStrop blades could be stropped and therefore did not need to be thrown away as often as Gillette blades.(3) The Gillette Safety Razor Company(GSRC) was about nine times the size of AutoStrop; in 1929 GSRC's assets were over $57 million while AutoStrop's assets were about $6.4 million.(4)(67) They were 1st and 3rd(67) largest and between them they controlled 80% of the razor trade in the US.(50) In addition, Gaisman’s net earnings were over $1 million per year at AutoStrop and climbing faster than GSRC’s net earnings.(30)(67)(77)

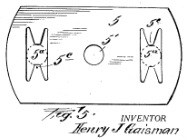

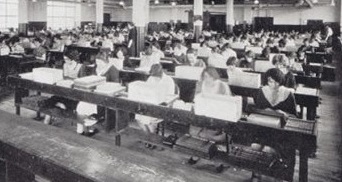

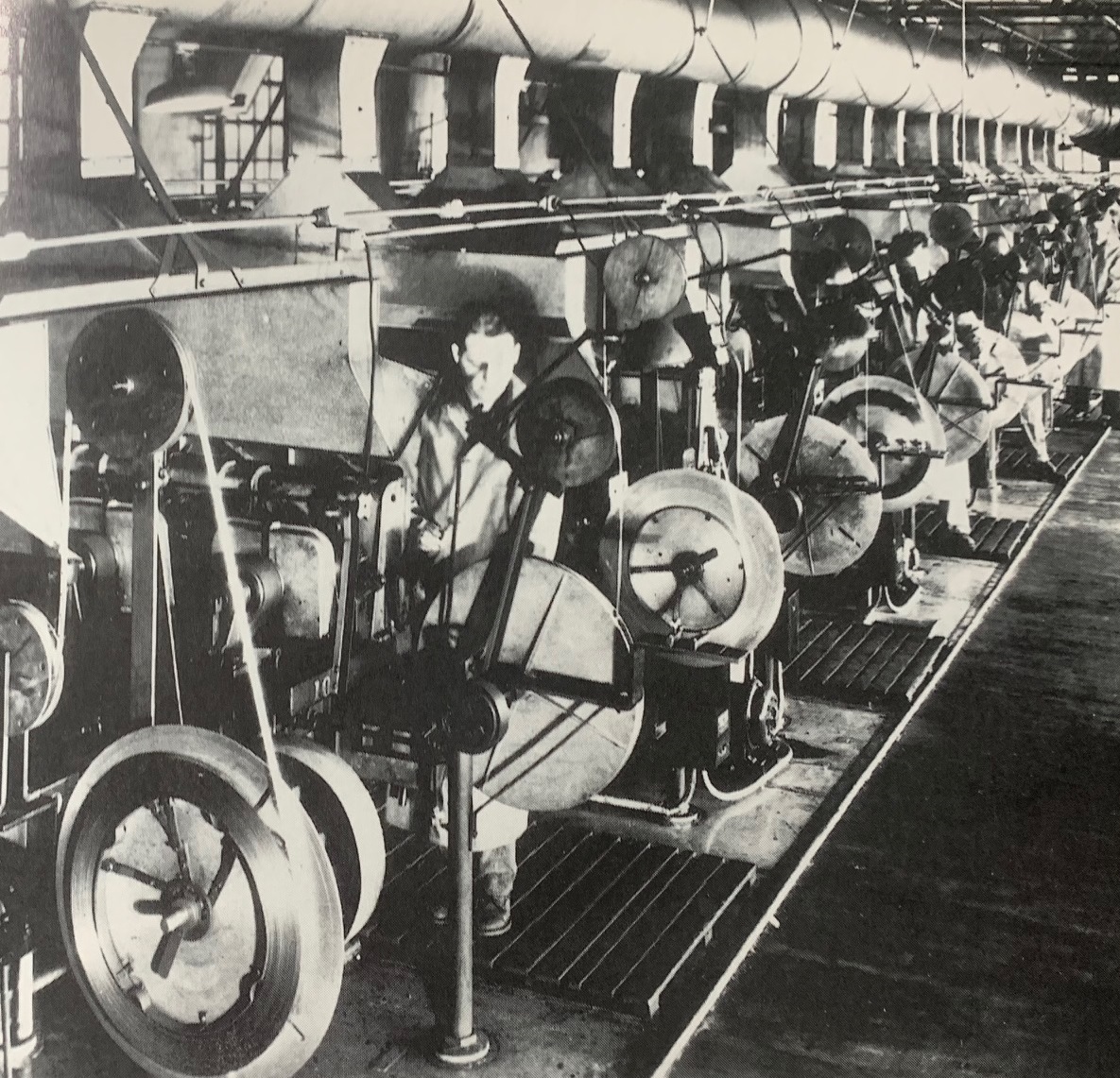

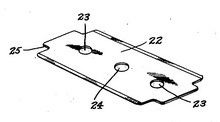

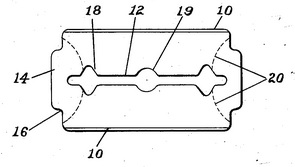

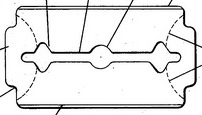

After the expiration of King C Gillette’s original patent (US775134A) of the double edge disposable blade on November 11, 1921, the field to legal competition on blade design and manufacture becomes wide open.(48) Gaisman recognized that with GSRC having nearly all the market share and no patent protection an opportunity presented itself; saying “I can see a barn door when it’s open”.(47) On October 6, 1923 at the age of 53 Gaisman applied for a patent (US1658435A) on a double edge razor and blade that was an improvement over the design of GSRC's 3 hole blade configuration.(7) Later he would say “I just wanted to make a better blade.”(81) Gaisman's blade holes had an "H" configuration or “Butterfly channeling”(16) whereby the alignment pins of the razor and the blade holes cooperated with each other to resist movement of the blade relative to the guard. This allowed for easier blade making while improving performance at better economy. Gaisman, 0n December 19, 1911, had also been granted a patent (US1011938A) for a blade manufacturing process where the edges were tempered to make them harder and sharp while leaving the central horizontal middle/intermediate portion of the blade less tempered and therefore less likely to crack or break lengthwise.(5) GSRC’s blades had no such tempering and as such there was a problem with GSRC's razor/blade combination that if they were over-tightened or the razor was dropped, the blades would crack.(6) Also, the GSRC blades, because of their positioning method, needed to be manufactured to a greater tolerance; 1 thousandths of an inch.(17) This precision increased manufacturing costs and tended to cause more quality control issues for GSRC. Further, GSRC was still using an individual blade stamping method pioneered by William E Nickerson, an exceptional engineer that solved many of GSRC’s original manufacturing problems. His process required many separate steps and stations such as grinding, sharpening, and packaging. And, after each step, product moved and there were quality control inspections required.(18) At AutoStrop they used a “continuous strip” manufacturing process where many steps were eliminated requiring much less human intervention, product transport, inspection and expense. Gaisman knew his modern equipment provided a distinct competitive advantage.(79)

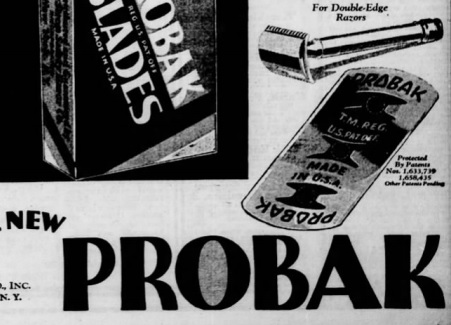

As early as 1926, Gaisman was pitching the idea to management at GSRC that they should purchase his company.(8) At first he was seeking as much as $10 million. This amount would not even be considered by the managers at GSRC. In February 7, 1928, Gaisman was awarded the patent on the previously mentioned improved “H” holed blade. The next day he filed for the trademark “PROBAK”. This trademark was issued on June 5, 1928 as registration number 0242751.(19) Gaisman’s plan was to sell AutoStrop and its PROBAK subsidiary to GSRC or produce and sell his blade himself; all the while gaining more leverage against GSRC. In the Fall of 1928, Thomas W Pelham, GSRC vice president in charge of sales and one of the top 3 managing executives, agreed to meet with Gaisman in New York at the Belmont Hotel. There Gaisman again laid out how GSRC should have AutoStrop but in any case he prepared to move forward on his own; GSRC demurred.(10) A year later in February of 1929, Gaisman again arranged a meeting with Pelham. This time in Boston at the Copley Plaza Hotel. Pressure was building as PROBAK was becoming more of a reality. Gaisman this time gave a more exacting figure - $5 million. And, again, this was too rich for GSRC.(9) Gaisman was not above threats as he made it clear. He would love to sell to GSRC, but he would soon be manufacturing his own double edge blades under the PROBAK brand.(10)

GSRC management understood AutoStrop’s advantages and their own weaknesses. So, GSRC tasked their MIT graduate and vice president of manufacturing Ralph Thompson to solve their problems themselves internally.(11) His solution to the blade cracking problem was to eliminate the old blade's rounded corners which were stress points. In March, a cutout corner was envisioned by Thompson and he applied for a patent (US1924262A) on April 25, 1929.(12) GSRC was also fearful that Gaisman's PROBAK blades would be used in their razors, so they endeavored to redesign their razor so that the PROBAK blades could not be used.

Then, Frank J Fahey, vice president and general manager, the man chiefly responsible for running GSRC,(104) produced a memo whereby he set the following limiting conditions on the new blade and razor design; 1) the new blade must be patented, 2) the new blade must fit all outstanding razors and the “New” GSRC razor, 3) the “New” GSRC razors must be designed so that no existing competitive blades can be assembled with them, 4) production targets at all plants must be up and completed in a timely manner. Also, because of weak public perception about their products, GSRC wanted to reset customer’s attitudes and to come out with a totally new product.(6) On a visit King C Gillette was asked his opinion and his preference was for diamond shaped holes. Another feature of the new GSRC razor was a horizontal bar that would block the PROBAK blade from being able to be used.(11) A patent for a blade to fit the blocking bar was applied for by GSRC on September 26, 1929 (US1826341) and again on November 27, 1929 (US1850902A).(14) Also, the diamond shaped holes were introduced allowing for less production precision.

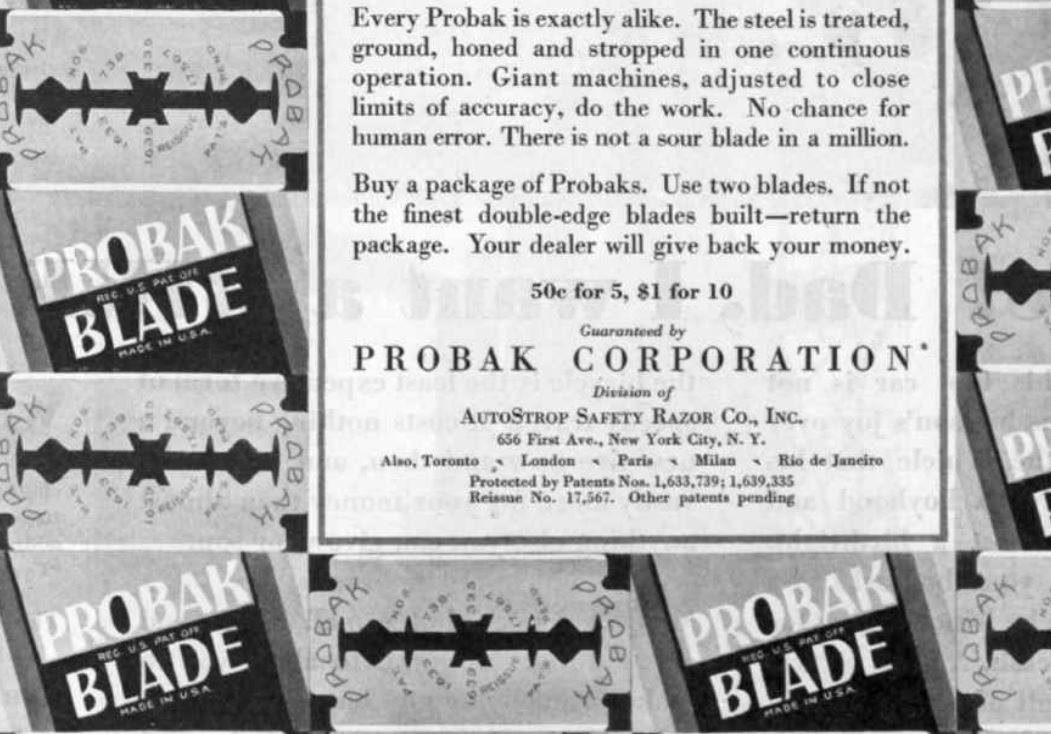

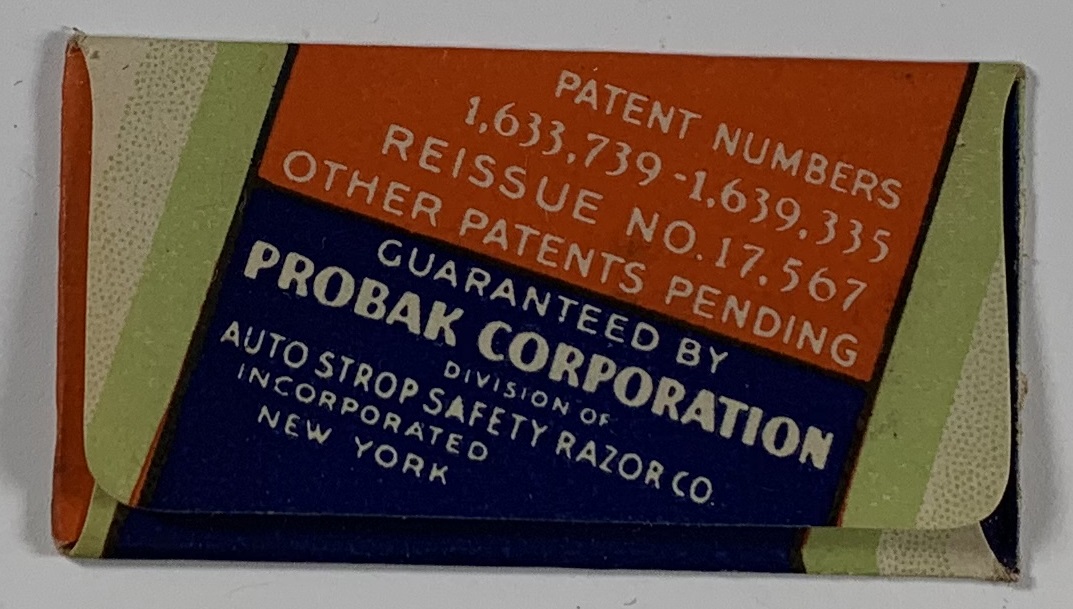

Gaisman was not idle while GSRC was working their plans. On June 14, 1929, AutoStrop announced in the press that they were preparing to produce and market a new blade under the trade name PROBAK.(13) This would be their “H” holed model for which Gaisman received a patent in February of 1928. No new financing would be needed in connection with installation of new machinery to produce the blade. Gaisman had been selling portions of his stock to the public since 1927 in preparation for this move. In this June time frame, the first advertisements start to appear announcing the new PROBAK blade. The price is in the premium range just like GSRC. 10 blades for $1 or 5 for $0.50. There is also a full refund guarantee so that if after you use two blades you are not satisfied, you can return product to the retailer. The competition gets slammed as “shark-toothed dull blades” more apt to torture than to shave. The ads tout the duo-tempered steel being at once both flexible (no breaking blades) and sharp. Also, the continuous strip manufacturing process is revealed where giant automatic all-in-one machines do the work with no chance for human error. Blades are more substantial too; being 17% heavier. Patent numbers US1633739A and US1658435A are also displayed; with some other unknown patents pending.(24) AutoStrop has a sizable advertising budget for the new PROBAK as ad placements flood the market both in the US and Canada. Ads are pretty much unchanged extolling the features and benefits of their new blade throughout the year.

At this time, John E Aldred was chairman of the board of directors for GSRC. He was a money man who had bought his way into the company by purchasing John Joyce’s GSRC shares from the estate on his death.(53) John Joyce was the original investor of $60,000 whose funding had saved King C Gillette’s fledgling company from oblivion.(31) John Aldred owned a consortium of bankers and investment people called Aldred & Company. Aldred was making $12,000 per year as director and Aldred & Co. was collecting $25,000 per year as GSRC’s fiscal agent.(83) In addition Aldred & Co. was collecting fees and commissions when GSRC needed financial help. Aldred as chairman of the board could control how much dividends would get paid out on GSRC’s earnings. He could also trade shares based on his knowledge of goings on at GSRC. Of course Aldred was aware of the new blade and razor developments at Gillette. So, about this time rumors of the new GSRC products started circulating on Wall Street. As early as August 7, 1929 the press(20) had gotten wind of these rumors as GSRC stock prices and Aldred’s investments started to go higher.(21) The cat was out of the bag. The press knew that GSRC was inventing a new razor and blade. Further, the new inventions would be patented for 17 years. These patents would offset the rising threat of competition. Sales of blades were brisk now and expected to continue to increase. Earning to shareholders would also increase. This news was according to those in close touch to the companies affairs.(21) Someone was leaking information on GSRC’s secret plans to affect stock prices up.

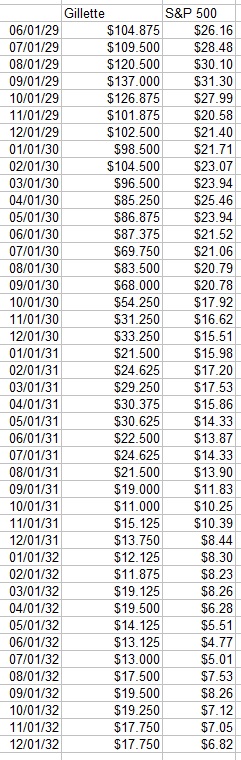

On October 24, 1929, it was announced in the press that GSRC has been working on a new razor and blade for many months and planned to start selling it in early 1930. Further, it is know that management is planning an $8 million to $10 million dollar global advertising budget to accompany the new products. Even expected production outputs are reported in the press to be 80,000 razors per day. Stockholders are having excellent expectations.(22) Design details are also starting to leaking out. For example, the press is reporting the new blade will fit the old razor but the old blade will not fit the new razor.(23) For investors everything is looking great. This does happen to be just prior to “Black Friday” where the stock market in general loses close to 30 percent of its value in one day to signal the start of the Great Depression.

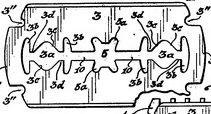

Then something amazing happens on November 18, 1929. Gaisman files to amend his patent that was awarded back in February 7, 1928. Ostensibly, he needed to change a couple minor details! What he does, without changing any drawings, is rename a few structures, like “holes” become “apertures” and “pins” become “studs”. All this seems innocuous enough. However, he adds 15 paragraphs of additional claims going from 8 claims to 23 claims. In doing so, he lays claim to any stud that is “non-cylindrical” in nature. Thereby he would own any blade design with an aperture or positioning hole that is non-circular. Remember, GSRC’s old-type blade has circular type holes. Gaisman does not claim that. But, under the new application diamond shaped holes would be owned by Gaisman. Also, it appears that GSRC’s horizontal slot in their blade, to mate with the razor’s blocking bar, is now off limits too. For some reason, the government official reviewing the greatly amended application grants all of Gaisman’s new claims. Was this just tremendous luck and foresight on Gaisman’s part that he was able to foresee all potential blade changes and reserve them for himself? Maybe. Or, did he discover Gillette’s new blade designs from loose lips before they became generally known? GSRC’s attorneys were later to claim the amendments to the earlier patent were illegal; that the reissue patent was not the same alleged invention as the original patent, but were an unlawful expansion. Further, such non-circular holes covered similar devices that were being used extensively by the public.(25) In any case, Gaisman’s February 7, 1928 patent goes pending again. It would be granted and reissued on January 14, 1930 as USRE17567E.

So, if Gaisman did not have GSRC’s designs, how was he able to file for new patent on December 10, 1929 using a drawing of a new design, supposedly of his creation that was an exact expansion on GSRC’s pending design submitted prior to him on November 27, 1929. Maybe Gaisman’s patent amendment on November 18 was his idea; albeit an illegal expansion of his prior application. But, how could this new design’s patent application have occurred without some knowledge of GSRC’s upcoming blade? Look at the long horizontal slot to mate with a razor’s blocking bar. How about the two diamond shaped holes. I guess a million monkeys banging at random on a million typewriters given enough time will write the complete works of William Shakespeare! Gaisman’s blade works in the “New” razor but the “New” blade doesn’t work in Gaisman’s razor! Because of this fact, GSRC would have had no economic incentive to copy Gaisman’s design (belying a later claim that GSRC had stolen from AutoStrop). The way these designs look – full advantage to AutoStrop! GSRC got totally out flanked and out maneuvered. In this chess game it was like Gaisman just took GSRC’s queen.

Supposedly, apart from the fact that there will be a new type blade and razor, GSRC has made no announcement of the details of the design as of December 20, 1929.(26) However. another news article states the company will release a new blade and razor soon, the design will be covered by patents, the details of which are not generally known.(27) Does this mean that people in the know outside of GSRC have seen the design details? Was GSRC test marketing samples in 1929? Were there prototypes blades sent to machine shop vendors so that GSRC could upgrade their blade stamping dies? Large scale advertising of about $7.5 million domestic was due to start in March 1930. By when did the publications need to have the advertising copy submitted – early November 1929? The design details were as simple as a line drawing of the new blade. With a line drawing, all of the blade dimensions could be extrapolated. What about the United States Patent Office? Once a patent is applied for, designs can be released to the public if an astute patent attorney knew what to ask for. Or, how about the possibility of a bribed patent officer? And why was such an expansive amendment and reissue allowed? What about GSRC employees? Could an employee have been paid to slip a sample to an outsider? A factory worker or someone in the design department would have had access to the “New” blades. Or, as GSRC was to declare, AutoStrop could have had a spy in the GSRC organization.(66) However, Gaisman found out, he did find out somehow! But, back to the sequence of events.

Starting on January 6, 1930 GSRC had their annual sales convention. This was usually a very grand affair where important employees and sales people from all over the world came to get the news and be seen at corporate headquarters in Boston. Speeches would be made. Banquets would be held. Future plans would be disseminated.(28) This year the convention would be extra special in that the participants would all learn of the “New” blade and razor. The press would be invited to some of the events, however they would be barred from learning the details of the new designs by private guards and police as the utmost secrecy would be implemented until the official advertising campaign. To coincide with the convention, all production of the old-type blades was to be discontinued and the new blade production would commence. The press is told the formal announcement of the new design will be in the March 8, 1930 issue of The Saturday Evening Post which will hit news stands on March 6, 1930. The last old-type blade was numbered 5,318,436,976 and distribution of the new blades and razors will commence on February 15, 1930.(29) Drug stores and retailers needed time to get product delivered and plan their own advertising campaigns to coincide with the March 6, 1930 date. Also, at this event Frank J Fahey takes the last old-style blade produced that day and inserts it into the first old-type razor ever produced. He then proceeds to shave with the combination and pronounces the shave as “excellent”.(17)

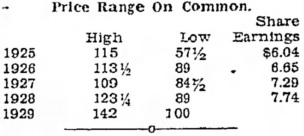

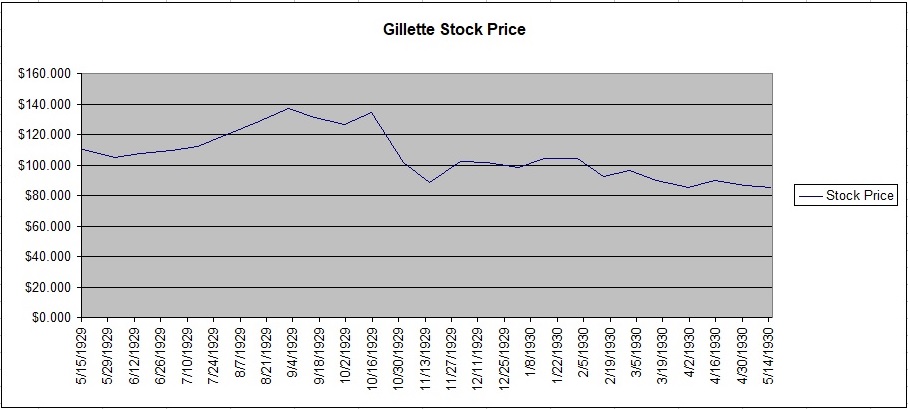

On Feb 7, 1930, John Aldred addresses rumors that have been being circulated on Wall Street for days that GSRC has willfully infringed on AutoStrop’s patents and that designs for the “New” blade and razor are not original to GSRC. Large distributors of GSRC’s new blades might also be sued. Also, there are hints at production problems and delays. Aldred tries to squash these rumors.(17) Who has started these rumors? Has AutoStrop out maneuvered GSRC’s management again? Short sellers start trying to drive down the price of the stock. Gaisman moves another piece on the chess board.(33) GSRC’s share price is now down in the $90 per share range from its high of $142 in 1929, a drop of about 37% in a few short months.(22) Also, It turns out Pelham has been severely discounting GSRC products to the point where, even at maximum production, profits for the year will be scarce or non-existent.(34) Further, all of 1930’s production capability for the year will have been sold via contracts in late March.(17) This is a major error and as such, Pelham, at 67 years old, is forced into a side management role; no longer chief sales general.(33) In late February 1930, Aldred & Company forms a pool of interested investors to buy shares of GSRC to prop up its alarming fall.(32) The stock price stabilizes in the mid $80s for a few months. Aldred is up for a fight.

GSRC was planning their huge reveal of the “New” Blade and “New” Razor on March 6, 1930. But yet again Gaisman out maneuvers them. In The Saturday Evening Post March 1, 1930 issue, PROBAK debuts their New blade one week ahead of GSRC. Gone are the “H” type holes. Instead what is seen is the same pattern as the “New” GSRC pattern but with some additional stamped cutouts.(35) This must have brought a very sick feeling to the team at GSRC. If they didn’t know how AutoStrop had bested them up to this point, it was painfully obvious now! PROBAK’s new blade would fit in their “New” razor and their “New” blade would not if in Probak’s razor. Not only that, PROBAK’s blade was fully patented with the reissued 17567 number., but, sadly, GSRC’s “New” Blade is still “Patent Pending”. Again, GSRC introduced their new razor and blade combination in The Saturday Evening Post March 8, 1930 issue with a huge 5 page color advertisement. Typically the lead time for such an advertising placement would have been 3 or so months. Therefore, GSRC would have had to provide advertising copy showing their new top secret ideas in the mid November to early December 1929 time frame. It turns out that Gaisman's AutoStrop was a substantial advertiser with The Saturday Evening Post; frequently running full page black and white ads. It is my belief that somehow Gaisman became aware of GSRC's top secret new designs from The Saturday Evening Post. If Gaisman was to see a proof of GSRC's advertisement layout then he would have all the information he needed to take action on behalf of his company. This is what I believe happened. Gaisman had received a patent on his "H" blade configuration on February 7, 1928. On November 18, 1929, Gaisman amended his 1928 patent to exclude GSRC’s non-circular holes. In addition he filed a new patent (US1876906A) on December 10, 1929 which included a super-set of all of GSRC's blade design features; corner cutouts, horizontal central bar slot and diamond shaped alignment holes. Gaisman's February 7, 1928 patent was reissued quickly with GSRC's new designs and Gaisman was able to retroactively patent the ideas for which Gillette was currently waiting on approval. Gaisman then sent in a black and white one page PROBAK advertisement to The Saturday Evening Post which ran March 1, 1930, one week before GSRC's big 5 page announcement.

As far as lead times and due dates for The Saturday Evening Post, a 5 page color spread would have had a much longer lead time than a 1 page black and white ad. Of course, there was only manual laborious printing processes at the time. No digital presses. Color separations would need to be prepared. The layout of the pages in the magazine for GSRC’s ad were such that the first page must be on only a right hand page and subsequent 2 page and 2 page ads needed to be opposite each other to make sense as a whole. All this would have required an early due date for ad copy. Norman Rockwell when he was providing artwork for the Christmas cover in the second week of December would need to have submitted by September 1st or about 104 days before publication. From November 18, 1929 to March 6, 1930 is 108 days. This was enough time to have gotten the newly submitted ad design from an unscrupulous or eager to please advertising sales person to AutoStrop. AutoStrop was the more regular client of The Post. However, the PROBAK ad had no such restrictions. It was a simple black and white 1 page ad that could have been placed anywhere in the magazine easily. A much shorter due date would have been allowed. In fact, Gaisman's PROBAK ad showed the new blade design in his ad printed with the reissue patent number 17567. This reissue occurred on Jan 14, 1930 and would not have been known until then. The new blade PROBAK ad shows in March 1, 1930 issue which would have hit the news stands 2 days earlier on February 27, 1930. Working back to Jan 14th this would have given Gaisman 44 days to submit his ad copy. So, Gaisman had the motive, the means and the opportunity. Of course this is just a circumstantial theory. Other explanations as that have been outlined could also have been the leaky source. Looking at PROBAK’s newspaper ads they start showing the reissue patent number in January 20, 1930 issues; a scant 4 days after Gaisman was issued the number.(36)

On March 6, 1930 the “New” razor and blade hit the news in all their glory. The products are being offered simultaneously in 150,000 retail outlets in North America. It comes to light that for several months GSRC has been asking users what was wrong with their safety razors. This information went back into the “New” design (or at least the design of the associated marketing promises). The advertising budget for 1930 in the United States will be $7.5 million or an increase of 50 percent over the previous year. Supposedly, the “New” razor has 12 new features. First and foremost is the elimination of “razor pull”. Pull apparently is caused by blade corners and these are no longer exposed. Sir, I have a bridge I’d like to sell you. Another feature is that the blade can be rinsed and dried without fully disassembling the razor. This will cause the blade not to rust. Amazing but true – carbon steel blades that wont rust! The blades are now safer to handle and the head is such that maneuverability on the face is improved. Meh! Maybe?(37) The “New” had been designed to thwart the competition and provide 17 years of patent protection. In this matter, the “New” is actually an abject failure.

Frank Fahey, concerned about rumors of impending patent litigation, sends a letter to shareholders stating GSRC has not infringed on anyone’s patents and “we are not only prepared for and legal controversy, but invite it”. News of this letter occurs the next day on March 19, 1930.(38) Fahey is about to get his wish because on April 3, 1930 AutoStrop files suit in Federal court in Wilmington, Delaware against GSRC for patent infringement.(39) And, also in New Haven Connecticut on April 9, 1930 a suit is brought against one of GSRC’s largest distributors – United Cigar Stores of Connecticut. This suit is an attempt to enjoin the distributor from selling any of GSRC’s new products.(40) Gaisman could very easily have said at this point “queen takes rook – check”!

A clue to GSRC management’s continual gross underestimation of Gaisman’s abilities is provided in Russell Adam’s great book where he quotes Frank Fahey as saying Gaisman’s tactical moves are just maneuvers by “the AutoStrop people with their Hebrew management”.(41) Of course Gaisman is Jewish.(81) For shame… Fahey is an anti-Semite it seems and letting his prejudices get in the way of clear business thinking. And, another interesting personal note, Gaisman is 61 years old and was living in a state of “contented bachelorhood” having never been married up to this point.(42, 65) At this time period statements such as he was a “confirmed bachelor” or stating that “he never married” are euphemisms for the person being a homosexual man. Does Fahey, who Adams presumes a Christian, disapprove and again underestimate Gaisman on this point too?

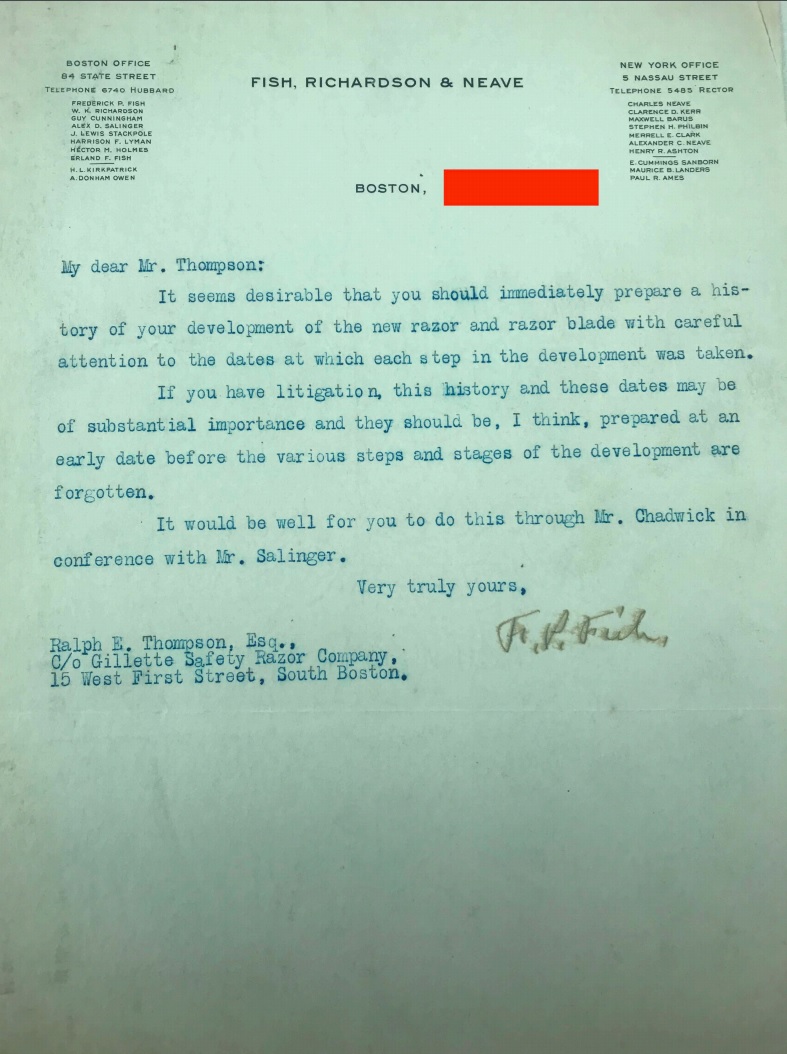

GSRC’s patent attorneys Fish, Richardson & Neave are on the case. They obtain information from Ralph Thompson and then prepare their counter attack on AutoStrop. On April 17, 1930 GSRC asks the United States District Court in Delaware to compel AutoStrop for more particulars and data in their charge of patent infringement.(43) By May 18, 1930 GSRC’s attorneys have seen the charges and they file answers to AutoStrop then. GSRC’s attorneys assert that the AutoStrop reissue patent USRE17567E is invalid and void as Gaisman was 1) not the original and first inventor of most if not all of the blade and razor improvements that were patented. And 2) that the same “improvements” were known and used by other in the US before his alleged invention. Further, GSRC attorney’s answer stated that 3) the reissue patent is invalid and void as said “improvements” do not even constitute a patentable invention as per patent laws. This was because said “improvements” were common knowledge on the part of anyone skilled in the art of blade and razors prior to his alleged invention. 4) That cancellation of the original patent US1658435A and its reissue was illegal because it was an unlawful expansion in an attempt to co-opt similar blades in use extensively by others in the public.(44) This rebuttal by GSRC’s attorneys would never be considered and decided upon by a judge in this case. GSRC and AutoStrop would later settle before a decision was made leaving these points moot for the time being because of a merger between the two companies. After acquiring this patent USRE17567E in the merger, GSRC would later use it to bludgeon blade competitors. However, this patent’s validity does get decided on in the United States Supreme Court on November 9, 1936. Justice Owen J Roberts stated in his majority opinion concerning the case of Essex Razor Blade Corp. v. Gillette Safety Razor Company that the patent was indeed invalid for lack of invention reversing the decision of the Circuit Court of Appeals.(45) In other words, GSRC would have ultimately won their defense of the patent infringement case with AutoStrop based on their answer point 3 above, patent invalidity. Albeit they might have had to take their case all the way to the United States Supreme court if AutoStrop did not give up in the lower courts. Initially GSRC’s management had the stomach for a fight as evidenced by Fahey’s March 18, 1930 letter to shareholders stating they invited any and all law suits. Why why why did GSRC give up the fight so easily?

The answer to the above question lies in John Aldred’s “pool” of GSRC stock to be described shortly. Being sued for patent infringement is generally bearish for a companies stock price. GSRC was no exception. Given that there was a general bearish trend for the stock market after the “Black Friday” massacre back in October 1929. And, given GSRC’s share price was generally frothy due to good news in February 1930 about the impending new product release and years of profits such patented product would provide, shorts were thinking GSRC’s stock was over bought and ripe for profits on the down side. Further, former vice president of sales Thomas Pelham had placed GSRC in a terrible position by contracting out all of GSRC’s factory production for the year at big discounts virtually locking in that earnings for 1930 would be weak or nonexistent and set a record for the down side. If additionally GSRC had to pay AutoStrop patent royalties on each blade being sent out, the losses for the year would be catastrophic. Patent litigation would also be expensive. On April 11, 1930, it was reported that GSRC’s earnings showed a large drop of over 50 percent when compared to the year ago period(46) (there were costs hitting profits associated with factory changes and new product roll outs too). The news was getting out and the bearish short traders on Wall Street were licking their chops ready for a sweet kill. John Aldred had to take action to protect his personal interests in GSRC shares.(47)

In February of 1930, Aldred started to convince large GSRC shareholders that a pool of buyers was needed to offset downward pressure from the short interest and indeed profits might be had by squeezing the shorts. Aldred was able to convince about 60 individuals and firms to participate in his buying pool to be managed by Aldred & Co for a fee. The pool started buying GSRC shares at about $100 per share. During the fight against the shorts, the pool had been able to acquire about 74,000 shares of GSRC stock at an average share price of $81.50 per share.(47) However, by June it was clear to Aldred that the pool was not going to be able to stem GSRC's stock share price decline. And, GSRC’s attorneys were having a change of heart and changing their advice as to the chances of winning the patent ownership battle in court.(52)

As the chairman of the board of directors, John Aldred could sense his pool could be a massive failure. Were the general trends too ominous for stock prices? Was he over exposed to GSRC shares? How would he sell his holdings in GSRC if the share prices continued to tank? Who would buy his shares? The pool was not working and in fact by July 28, 1930 the pool was sitting on a paper loss of about $1.7 million, a loss of 28 percent on a $6 million dollar investment.(47) What could he do? He might continue to take a bath. Well there was this issue of pending patent litigation at GSRC and AutoStrop. Here’s an idea! This and many of John Aldred’s problems would go away if GSRC and AutoStrop were to merge. Gaisman already had been making overtures. Why fight him? About the middle of June Aldred has a meeting with Gaisman’s representatives.(47) Aldred also instructs Henry Fuller, a director at GSRC and partner in Aldred & Co., to have more meetings with Gaisman’s camp. Fuller was embarrassed at doing such; feeling hat in hand as just a few months earlier he had firmly rebuffed Gaisman.(52) Aldred in his meetings determined Gaisman did prefer a merger, wanted this and initial negotiation were on. A frame work of a deal was established. Gaisman would accept 310,000 shares of GSRC in exchange for all the outstanding 310,000 shares of AutoStrop. Further details could be worked out later. But, if there was a merger, GSRC would need shares to trade and they could buy the shares in the pool! Aldred who was over extended now in shares of GSRC stock could be made whole again.(47) Fahey who wanted to fight Gaisman was weakened in that his ally Pelham was now out of the picture.(33) John Aldred must have been totally disgusted at the terrible management of GSRCo at the hands of Fahey and Pelham. Fahey had mismanaged the development of the “New” blade and razor products. Instead of a new earnings stream for years to come off of protected intellectual property, royalties would have to be paid to AutoStrop;(92) that or years of expensive litigation would ensue.(47) Pelham had practically given away the store with large discounts tying up the factories to sell at no profit.(34) It was now every man for himself and Aldred was going to distance himself from Fahey in favor of Gaisman.

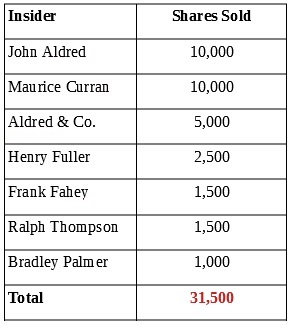

The merger had to go through. Aldred had decided it was time to substantially pare his personal holdings in GSRC. Aldred was also working it so GSRC would prop up the companies share price by buying shares on the open market in preparation to the merger. Does this sound like a conflict of interest? It was! So, the pool (directed by Aldred) and GSRC (directed by Aldred) were both working to keep the GSRC share price high. GSRC should have been trying to get those shares as cheaply as possible. But, this was all to Aldred’s great personal benefit. The pool had 74,000 shares he had purchased at $81.50 each.(47) GSRC needed 310,000 shares to buy out Gaisman. GSRC had 795,000 shares still unissued but that wouldn’t help Aldred’s loss if those were used.(98) Instead GSRC started buying shares of its own stock on the open market with $25 million loan money from Aldred & Co. arranged by Aldred for a fee.(47) Cozy deal! This was all approved on the July 10 director's meeting. From July 10 to August 1930 GSRC had manged to acquire on its own 115,200 shares in the open market at $75.84 per share.(70) So, the directors of the pool (Aldred) negotiated with the directors of GSRC (Aldred) to buy 60,000 shares of the pool at $83.25 per share on July 28th!(70) All this at a profit to the pool of about $105,000! Personally Aldred had snatched victory from the jaws of defeat and a one time $1.7 million dollar paper loss was now a gain.(47) Chunk by chunk Aldred’s personal holding in GSRC stock were decreasing and he was selling at top dollar too. GSRC now had 175,200 shares of the 310,000 that Aldred needed to complete the merger. Where would GSRC get the additional 135,000 shares? Well GSRC could buy them directly from the companies directors! The ship was sinking and it’s time for all the big insiders to cash out. The King is dead - long live the new King – King Gaisman. On August 11, 1930 the GSRC directors approved this new purchase from the individual directors/shareholders.(47) The individual directors sold an additional 31,500 shares directly to GSRC in a private sale.(70, 101) This was for $80 per share. Old King C Gillette sold 20,000 shares to GSRC at an average price $82.50.(70) Other non-director shareholders sold 18,971 shares at $82.50 too.(70) The average price GSRC had paid for all these 245,671 shares was $79.26.(47) Now, without anymore buyers propping up GSRC’s share price, the bears would have a field day. Aldred could care less. He was substantially divested by this point. By January 1, 1931, GSRC’s share price would plummet to $21.50 a share! The merger between GSRC and AutoStrop was just a mechanism for John Aldred to sell his personal holdings to GSRC not on the market at a favorable price.

By August Aldred had divested many of his personal shares. Henry J Fuller would say in the November 18, 1930 shareholders meeting to ratify the merger agreement that the Aldred & Co. held 156,000 shares and that their holding for the year had actually increased!(50) The Securities and Exchange Commission whose purpose is to promote truth and protect small investors from fraud and manipulative practices would not be formed until 4 years later on June 6, 1934. This was the Wild West. Fuller’s was implying Aldred & Co. was buying during the year, but of course they were actively selling. This was designed to instill confidence in the other shareholders so they would vote for the merger. Consider this, Aldred in 1917 had purchased the majority controlling interest in GSRC.(53) Even if the probably inflated 156,000 share figure was accurate, that still only represented 7% of the 2,205,000 outstanding shares. Aldred had gone from the majority holder in 1917 to an also ran in terms of percent ownership in GSRC. And, the 156,000 number would only be this high because a recent small shareholder lawsuit had forced two buybacks, one of 31,500 shares(70) and another of 15,440 shares (245,671 – 198,731 was 31,500 + 15,440), not because Aldred & Co was bullish on GSRC! Aldred was paving the way for a new regime headed by Gaisman to take the helm at GSRC and executing his exit plan. Gaisman would soon control more than twice as many shares as Aldred. All that was left was to negotiate with Gaisman the final terms of the surrender/merger. Checkmate for Gaisman.

Back to August, 1930. Part of the negotiations with Gaisman included agreement for AutoStrop’s auditors to look at GSRC’s books. AutoStrop’s audit in August would show that profits had been inflated by GSRC booking foreign transfers as sales when in fact the products were actually just sitting in foreign warehouses unsold!(54) Fahey and Pelham were responsible for this. They justified themselves by saying less foreign taxes would need be paid by their accounting methods.(107, 108) They had inflated profits using slight of hand tricks and were then erroneously awarded big bonuses for doing so.(55) The bonuses they had voted for themselves were in excess of $500,000 between 1924 and 1929; in addition Fahey took a $100,00 salary and Pelham took an $85,000 salary per year.(99) This would complicate the negotiations and further annoy Aldred at Fahey’s and Pelham’s mismanagement. For it was Fahey and Pelham’s actions that had caused Aldred to give up on GSRC. AutoStrop’s audit would say that GSRC’s stated earnings in 1928 and 1929 were short by about $7 million or 23% less than reported if the foreign transfers were reversed off the books.(47) And, for the five year period back to 1925 GSRC had over stated profits by $11,856,000. Because of this new revelation, Gaisman broke off negotiations temporarily in August but came back with altered demands.(100) At Aldred’s insistence, GSRC had gone from hat in hand to bowed head and bent knee. Aldred could care less by this point calling it a “trifle”.(55, 100) His plan was largely executed. Aldred was now whole, had given up the fight and largely bailed on GSRC. Instead of 310,000 shares of the standard GSRC common stock, Gaisman would now want a special heretofore unheard 5% preferred stock to be created. This was huge for Gaisman. Even though Gaisman had initially wanted 25 percent of GSRC common shares, he settled for 14 percent ownership of the preferred shares.(103)

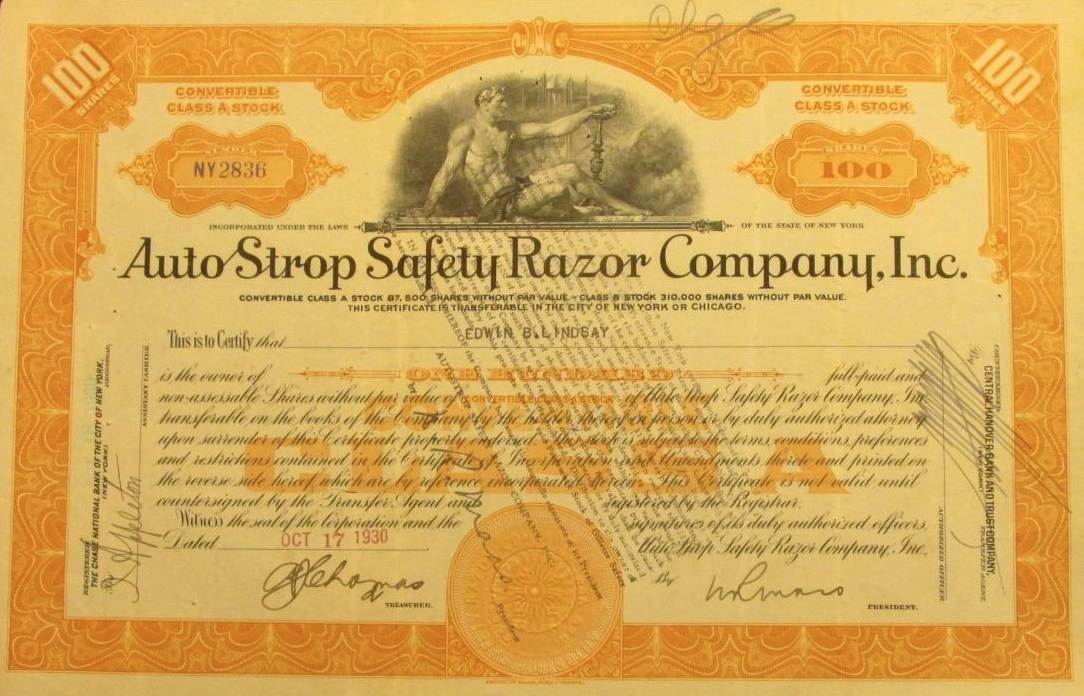

AutoStrop had 310,000 shares of their stock outstanding. This represented full ownership in Gaisman’s company. Gaisman owned the majority of these shares. The shares in AutoStrop were of two types Class A and Class B. Usually Class B shares are limited in some way as to not get dividends or not have voting right control in the company. There were 87,500 shares of Class A and 222,500 shares of Class B.(51) But that doesn't really matter as far as GSRC was concerned, they were buying each and every one and not making any distinction between them. What the shareholders of AutoStrop were going to get was 310,000 shares of a new class of GSRC Stock(56) which would be available as soon as shareholders of both companies approve the deal November 18, 1930.(69)

This new class of stock that Gaisman would get was a preferred stock. Preferred stock(58) gets paid a dividend and stands in front of common stock(57) as far as claims against GSRC if things go south and assets get sold in a bankruptcy.(61) Gaisman had also negotiated a special provision that the GSRC preferred would have voting rights in meetings to control the actions of GSRC. This was an unusual right not typically afforded to preferred shares, but imperative to Gaisman as it would give him say on the board of directors. Also the preferred shares could be converted back into common at the holder’s option. And, most importantly in another victory for Gaisman, these shares carried a 5% dividend that the previous common deal did not have. With this dividend GSRC was now guaranteeing the AutoStrop shareholders an annual payment of $1,550,000 or $5 per share.(67) The common stock had no such guarantee and only would get paid a dividend if the board of directors (of which Gaisman would shortly head) approved of it. The preferred would now get paid any GSRC profits first then the common and only if there was left over profit available. Gaisman was pushing the old guard at GSRC, who only had the common stock, back away from the feeding trough.

Aldred said yes. Why not? He had sold most of his common by this time. Aldred wouldn’t be getting any share of GSR profits as dividends now anyway. As of November 21, 1930 there would be two listings for GSRC in the stock market price sheets; the old common and the new preferred.

On the day of the shareholder’s approval of the merger in November, GSRC had available 198,731 shares(49) of their own companies stock for the merger exchange. Those shares would be reclassified into 310,000 shares of convertible preference stock. Prior to the deal GSRC had 2,205,000 shares outstanding. The 198,731 shares would be removed from the books but two reserves needed to be added. 310,000 of common in case any of the new preferred gets converted back to common. Also a reserve of 200,000 would be needed because the $25 million loans GSRC had taken from Aldred & Co. would be paid back by issuing debentures(59) (bonds) which also had a convertibility option feature.(60) And of course there would be a commission paid in 12,500 shares of common stock to the brokers handling all these transactions. All this leaves a total pool of 2,528,769 shares of common stock after the transaction.(62)

We need to recap 1930 up to this point, In February 1930 with great expectations, Aldred forms a pool to fight the bears and is a buyer of GSRC shares. The pool doesn’t work because Fahey has mismanaged the new GSRC products that have been developed (no clear title to the patents exist). Fahey wants to fight Gaisman on the patent ownership. Aldred decides the shorts are right and instead to cut his losses and start selling GSRC. Who will buy? Let “Mikey” eat it. GSRC will buy. Aldered confirms with Gaisman the framework of a merger deal. Aldred makes GSRC borrow $25 million from his bankers to start buying shares. GSRC is supposedly doing this because the merger is good business. GSRC is buying buying buying. Aldred and the insiders are selling selling selling. In August 1930 Aldred has to let Gaisman audit the books. More crap for Aldred to deal with because of dumb and dumber’s mismanagement at GSRC. New deal struck with Gaisman for the preferred stock. GSRC stock starts dropping dropping dropping as the company has all the shares it needs for the merger now. Natural market forces are restored. But Aldred needs his $25 million loan money back. Who will pay back the loan? The public will. Next phase of the story follows.

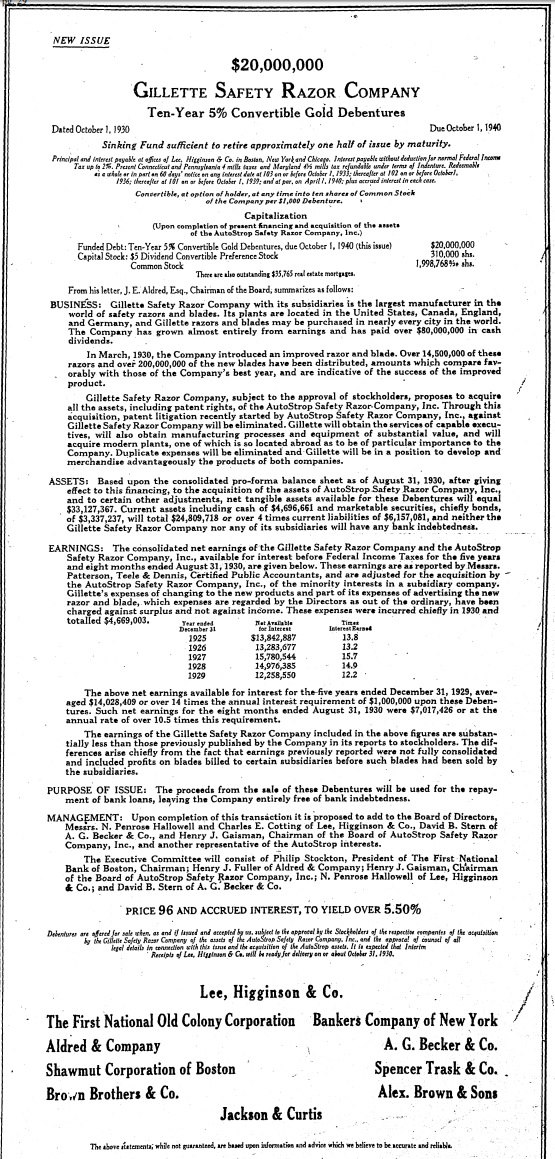

The $25 million loan from Aldred’s banks to GSCR needs to be paid back. You see Aldred has gone from large holder of stock in GSRC to a large holder of debt in GSRC. Better but not great. More of the exit plan needs to happen. The next part of Aldred’s plan is to have GSRC issue public bonds to pay back the loans.(63) Specifically, Aldred engaged an underwriter, Lee, Higginson & Co. to start selling bonds on October 1st. Here’s what the public buyers would get. For each $1000 purchase they would have a claim against GSRC that GSRC would legally have to honor. This claim stands in front of the preferred stock and the common stock if things go south at GSRC, GSRC can't pay their bills and the company gets liquidated. First and foremost the public would get a 5% "coupon"(64) which means they would per year get a payment of $50. To sweeten the deal the underwriter's said you only have to pay us $960 for the $1,000 face value bond. These bonds/debentures were "convertible"(60) which means they could be presented back to GSRC and GSRC would give you 10 shares of common stock in exchange. GSRC stock in October is now down to $54 per share. Conversion to common stock at that price would be a terrible deal ($540 for 10 shares versus $960 for one bond), but having options is good especially if the stock price jumps dramatically. Further these bonds were "gold debentures". What does that mean? If the bonds were held to maturity 10 years later in 1940, not only would you get $50 cash per year and the option of convertibility to common shares, but at the end you could get $1,000 worth of gold at term instead of cash dollars. Plus there was a market for these bonds you could just sell them to someone else if you wanted to get out of the deal. Sales like these happen and the $1000 bond gets sold either at a premium or a discount depending on the market for them at any given time. So, as the underwriter is selling the GSRC bonds to the public, cash is accumulating at GSRC. GSRC will use this cash to pay back the $25 million loan taken from Aldred’s banks. After the loans get paid, Aldred will have minimal presence in GSRC. Voila! Exit plan complete. Well that was Aldred’s hope. Things wouldn’t turn out to his plan. The small shareholders would have their say in the matter.

Does it sound like the little guy is getting totally abused in this story? They are! And they aren’t going to take it any more. On October 30, 1930 the small shareholders sue the GSRC board of directors for $20 million. From this suit we discover much of the internal goings on at GSRC. The small shareholders have caught on to some of Aldred’s and the insider’s shenanigans. In the suit they allege the defendants: John Aldred, Henry Fuller, Frank Fahey, Thomas Pelham, Ralph Thompson, King Gillette and 5 others(86) have had GSRC borrow $20 million (not all of the $25 million was needed) and run up the share price from $58 ½ to 85 ¼ in the month of July so that they could sell their personal shares to the company at high prices. They want to block the directors from creating the new preferred shares and they declare the insider sales to GSRC are illegal and said sales should be rescinded and profits paid back. Basically they want to block the merger as negotiated. Of course the directors on the following day issue a denial of any illegalities and say that they were only acting in the best interest of the GSRC which is to merge with AutoStrop.(71) Further that failure to merge will be very harmful to the shareholders causing a further drop in the share prices and that the pool share sale prices were a bargain to GSRC.(72) The directors offer that at the upcoming November 18th shareholders meeting to approve the merger that they agree that no resolution shall be passed to have GSRC absolve them of their personal liability for their prior actions and the merger vote should go through.(73) The small shareholders agree to this and drop their demand for an injunction to stop the merger vote.(74) On November 18, 1930 the GSRC shareholders approved the merger; the vote was 1,399,654 in favor with 895 opposed.(75) The shares set aside by GSRC to reclassify into preferred is now 198,731 because sales of 46,940 shares have been reversed due to pressure from the small shareholder’s law suit.(76) Aldred’s exit plan had fallen apart at this point and he will be fighting to stay out of jail.

With the directors now facing intense scrutiny and a judge, they all start defending the merger. Why is the merger good for shareholders? Turns out they don’t want to go to jail for illegalities associated with selling their shares at a profit to GSRC at inflated prices. Therefore, the merger was now all about how great it would be for GSRC, they were only acting in GSRC’s best interests, and they would never act for their own personal gain! The following reasons were given as why the merger was pursued. 1) Elimination of patent ownership litigation with AutoStrop.(63, 109) 2) Consolidation of each companies Sales, Manufacturing and Advertising departments at $1 million per year saving,(109) 3) AutoStrop had a goodwill value of $30 million.(109) 4) Competitor nuisance elimination value of $5 million to $10 million.(109) 5) Advantages of pooling both companies patents. 6) AutoStrop expects to earn $2 million in 1930.(67) 7) Elimination of lawsuits against GSRC’s large distributor United Cigar Stores of Connecticut.(106) 8) If the merger did not now go through, GSRC shares would plummet in the market.(72) 9) GSRC would obtain the services of capable executives.(63) 10) GSRC would obtain manufacturing processes and equipment of considerable value.(63) 11) GSRC would acquire AutoStrop’s modern plants especially an overseas one where GSRC had not footprint.(63) All this for only 198,731 shares of stock purchased by GSRC for the low low price of about $16 million.(67)

The new AutoStrop regime now moves in for the take over of GSRC. The New York Stock Exchange shows its muscle because they stipulate that they will refuse to list GSRC stock unless Fahey and Pelham are removed as managing officials of the company.(105) At the November 18, 1930 directors meeting Fahey and Pelham refuse to resign and are summarily fired out of their executive management positions at GSRC by the board while retaining their board seats for the time being.(105) On November 26, 1930 it is reported that Gaisman is to be the new head man at GSRC.(67) Gaisman will get an additional board seat for an ally N. Penrose Hallowell. The bond underwriters will also get two new seats.(68) One of the new boards first actions is to defer the April 1, 1931 divided to the GSRC common stock holders.(84) Of course the preferred holders still get theirs but the old guard gets punished. Profits must be conserved. There will be costs associated with upgrading GSRC’s manufacturing equipment and processes, but ultimately expenses are being reduced and quality will improve.(85) Remember too the interest on the debentures has to be paid before the common dividends too. The following write-offs against earnings had to be made to clean up the books: $4,669,004 deferred development expenses (new costs expected for the future), $732,028 loss on treasury stock marked to market, $1,402,243 obsolete machinery, $476,591 cancellation of employee stock subscriptions. On April 22, 1931, Frank Fahey, Thomas Pelham and Ralph Thompson are kicked off the board of directors at the annual meeting, but King Gillette, John Aldred, and Henry Fuller of the old guard still cling to their seats.(87) On May 1, 1931, Henry J Gaisman gets elected chairman of the board and of the executive committee and Gerard B Lambert gets elected president of GSRC replacing King Gillette.(88, 89) Fahey, Pelham and Thompson were all made to repay illicit bonuses on the misstated earnings years.(102) Thomas Pelham goes to work for GSRC competitor Segal Lock and Hardware Company as a director and vice president in charge of their blade and razor division on May 16, 1931.(90. 91) However, Pelham has difficulty making a go of it as he files for bankruptcy on May 10, 1932. Among the assets listed are $47 cash on hand.(110) Apparently Gaisman has bested Pelham at both GSRC and Segal. Frank Fahey goes into retirement.(94) Ralph Thompson gives up all rights to the patents he generated while at GSRC and goes on to be president of the William L Gilbert Clock Company and serve as chairman of board of directors for multiple companies.(95) John Aldred is out at GSRC by June of 1931(96) Aldred’s fortune, house and possessions, one time estimated at $80 million, are gone by 1939 having been liquidated by his creditors.(113) On August 18, 1932 the small shareholders suit settles with the former directors agreeing to pay $400,000 to the plaintiffs.(111) No one will go to jail. GSRC must pay plaintiff’s attorneys fees of $275,000 plus $32,880.07 in expenses.(112)

So, what of Henry Jaques Gaisman? He buys an exclusive 106 acre estate near Hartsdale, New York with large Italian Renaissance type house and outbuildings with a private lake in the mist of an extensive woodland.(97) He retires in 1938 from GSRC at the age of 69.(115) And, at 83 years old, he marries his love Kitty Vance who was his nurse that he met when she was 29 a few years earlier. He is worth in excess of $25 million and goes on to live another 21 years with her while practicing philanthropy.(114, 115, 1)

Bibliography & Notes

(1) New York Times, 1974-08-07 P38

(2) Patent US759262A

(3) Adams P70

(4) New York Times 1930-08-08 P30

(5) Adams P146, US1011938A

(6) Adams P140

(7) US1658435A

(8) Adams P146

(9) Adams P148

(10) Adams P147

(11) Adams P149

(12) Patent US1924262A

(13) New York Herald Tribune 1929-06-15 P21

(14) US1826341A, US1850902A

(15) The Muldrow Sun, 1927-08-19 P1

(16) The News-Palladium, 1929-11-21 P9

(17) Fortune Magazine, 1930-04-01

(18) The Gillette Blade, 1927-09 P42,P47,P50.61

(19) USPTO

(20) Brooklyn Times Union, 1929-08-07 P9

(21) The Cincinnati Enquirer, 1929-08-24 P16

(22) Time Herald, 1929-10-24 P8

(23) The San Francisco Examiner, 1929-10-25 P35

(24) St Louis Post-Dispatch, 1929-06-04 P7

(25) New York Herald Tribune, May 29, 1930 P2

(26) Daily Boston Globe, 1929-12-20 P32

(27) The San Francisco Examiner, 1929-12-31 P20

(28) Daily Boston Globe, 1929-01-10 P14

(29) Business Week, 1930-02-12 P17

(30) New York Times, 1929-10-18 P52

(31) Adams P43

(32) Adams 153

(33) Adams 152

(34) Adams 151

(35) The Saturday Evening Post 1930-03-01 P123

(36) Spokane Chronicle, 1930-02-20 P17

(37) Daily Boston Globe, 1930-03-06 P9

(38) Daily Boston Globe, 1930-03-19 P2

(39) New York Herald Tribune, 1930-04-04 P16

(40) New York Herald Tribune, 1930-04-10 P43

(41) Adams P155

(42) New York Times, 1952-04-30 P29

(43) New York Herald Tribune, 1930-04-18 P32

(44) New York Herald Tribune, 1930-05-29 P2

(45) United States Reports Volume 299 U.S. 94 1936-11-09

(46) The Knoxville Journal, 1930-04-11 P21

(47) Fortune Magazine, 1931-10-01

(48) Adams P107

(49) New York Herald Tribune, 1930-11-19 P38

(50) Daily Boston Globe, 1930-11-19 P19

(51) New York Herald Tribune, 1930-10-8 P35

(52) Adams P156

(53) Adams P94

(54) Adams P158

(55) Adams P159

(56) Daily Boston Globe, 1930-10-16 P14

(57) Ross P919

(58) Ross P928

(59) Ross P921

(60) Ross P920

(61) Ross P918

(62) New York Herald Tribune, 1930-11-20 P30

(63) New York Herald Tribune, 1930-10-17 P29

(64) Ross P103

(65) Waits P403

(66) Adams P150

(67) Business Week, 1930-11-26

(68) New York Times, 1930-10-16 P41

(69) New York Times, 1930-11-20 P47

(70) Daily Boston Globe, 1930-10-31 P1

(71) New York Times, 1930-11-01 P28

(72) Daily Boston Globe, 1930-11-04

(73) Daily Boston Globe, 1930-11-08 P17

(74) New York Times, 1930-11-08 P27

(75) The Washington Post, 1930-11-19 P20

(76) New York Times, 1930-11-04 P43

(77) Forbes, 1929-05-01 P76

(78) Time Magazine, 1930-04-01

(79) Forbes, 1930-05-15 P54

(80) Time Magazine, 1930-10-27 P41

(81) New York Times, 1971-05-12 P42

(82) Fortune Magazine, 1931-06-01 P 154

(83) Daily Boston Globe, 1931-01-06 P6

(84) Daily Boston Globe, 1931-02-27 P30

(85) The Pittsburgh Press, 1931-02-28 P12

(86) New York Herald Tribune, 1931-04-01 P38

(87) Daily Boston Globe, 1931-04-22 P20

(88) Daily Boston Globe, 1931-05-02 P17

(89) New York Times, 1931-05-02 P33

(90) New York Times, 1931-05-16 P33

(91) The Philadelphia Inquirer. 1931-05-16 P20

(92) New York Times, 1931-05-31 PX7

(93) Patent US1272415A

(94) New York Times, 1945-02-20 P19

(95) New York Times, 1952-09-16 P29

(96) New York Times, 1931-06-02 P30

(97) New York Times, 1931-06-10 P48

(98) Daily Boston Globe, 1931-07-10 P14

(99) New York Times, 1931-07-15 P15

(100) New York Times, 1931-07-16 P2

(101) Daily Boston Globe, 1931-07-17 P8

(102) Daily Boston Globe, 1931-07-18 P18

(103) Daily Boston Globe, 1931-10-29 P17

(104) New York Herald Tribune, 1931-10-31- P30

(105) New York Herald Tribune, 1931-11-17 P29

(106) Daily Boston Globe, 1931-12-12 P3

(107) Daily Boston Globe, 1931-12-29 P13

(108) Daily Boston Globe, 1932-01-12 P27

(109) Daily Boston Globe, 1932-04-09 P20

(110) Daily Boston Globe, 1932-05-10 P18

(111) New York Times, 1932-08-18 P37

(112) Daily Boston Globe, 1932-08-30 P24

(113) New York Herald Tribune, 1945-11-23 P24

(114) New York Times, 1952-04-30 P29

(115) Binghampton Press, 1952-04-29 P1

Adams, Russell, King C. Gillette: The Man and His Wonderful Shaving Device, 1978, Boston, Little, Brown and Company, ISBN 0-316-00937-7

Dowling, Tim, Inventor of the Disposable Culture: King Camp Gillette 1855-1932, 2001, London, Short Books, ISBN 0-571-20810-X

Krumholz, Phillip L, Collector’s Guide to American Razor Blades, 1995, Bartonville, Krumholz, ISBN 0-9620987-3-6

Krumholz, Phillip L, The Complete Gillette Collector’s Handbook, 1992, Bartonville, Krumholz, ISBN 0-9620987-2-8

McKibben, Gordon, Cutting Edge: Gillette’s Journey to Global Leadership, 1998, Boston, Harvard Business School Press, ISBN 0-87584-725-0

Ross, Westerfield, Jaffe, Corporate Finance, 2002, New York, McGraw-Hill, ISBN 0-07-115088-9

Waits, Robert K, A Safety Razor Compendium, 2014, Sunnyvale, Waits, ISBN 978-1-312-29353-3